Price crisis, demand recession plague Iran’s housing market

Given the stark gap between prices and incomes, the question arises: are today’s housing prices realistic and sustainable, or are they inflated and speculative? The answer is a mix. On the one hand, rising construction costs (materials, wages, land) nominally justify current prices. On the other hand, the absence of consumer demand and declining transactions indicate this price level is unsustainable in the long term.

By Amin Shojaei

Economic researcher

Iran’s housing market entered the calendar year 1404 (March 2025–March 2026) with clear signs of a deep recession accompanied by an apparent price increase. Over the past decade, housing has transformed from a consumer good for households into a tool for preserving asset value against inflation. This fundamental shift has changed the structure of demand and turned homeownership for the middle class into a distant dream.

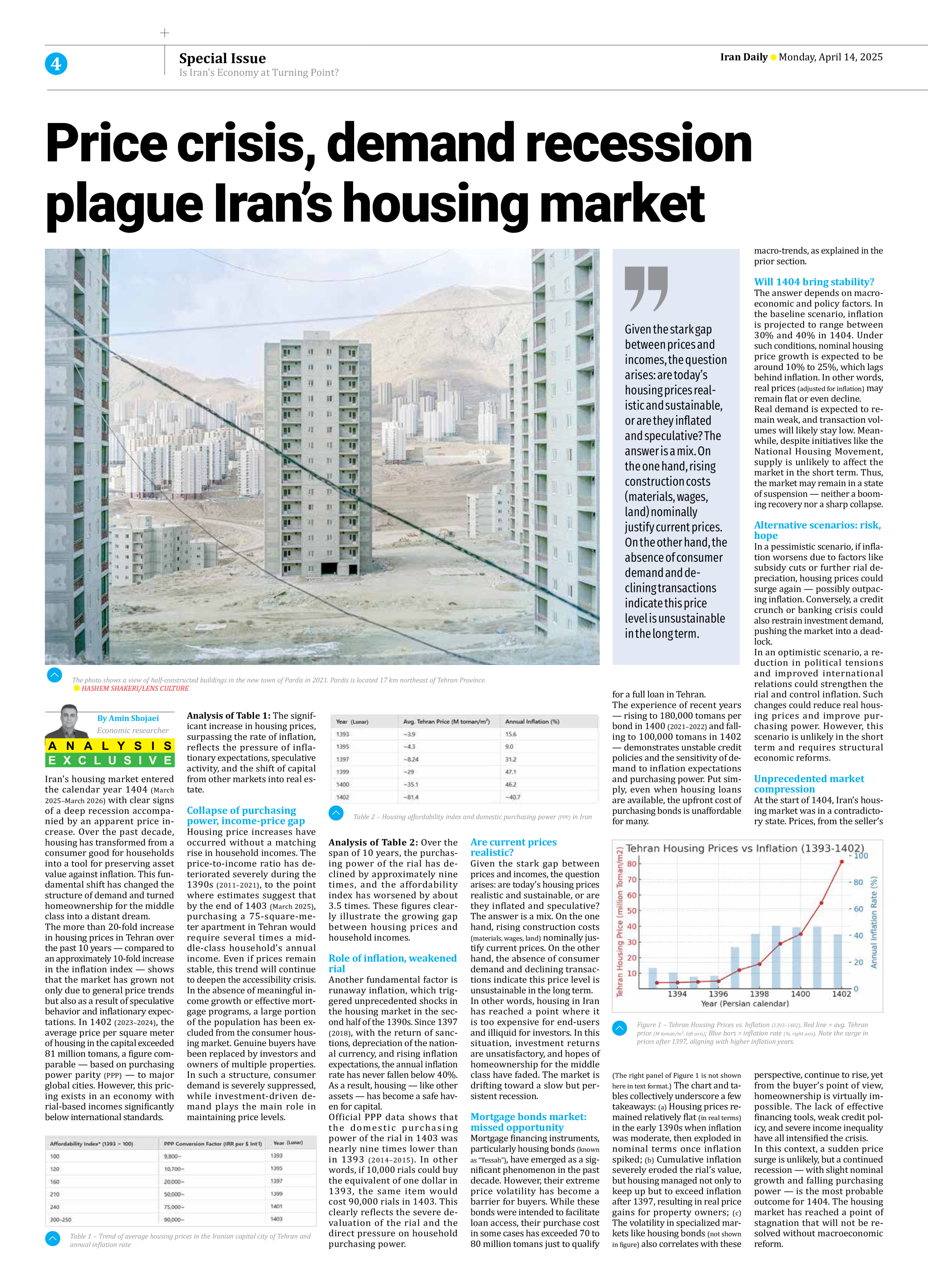

The more than 20-fold increase in housing prices in Tehran over the past 10 years — compared to an approximately 10-fold increase in the inflation index — shows that the market has grown not only due to general price trends but also as a result of speculative behavior and inflationary expectations. In 1402 (2023–2024), the average price per square meter of housing in the capital exceeded 81 million tomans, a figure comparable — based on purchasing power parity (PPP) — to major global cities. However, this pricing exists in an economy with rial-based incomes significantly below international standards.

Analysis of Table 1: The significant increase in housing prices, surpassing the rate of inflation, reflects the pressure of inflationary expectations, speculative activity, and the shift of capital from other markets into real estate.

Collapse of purchasing power, income-price gap

Housing price increases have occurred without a matching rise in household incomes. The price-to-income ratio has deteriorated severely during the 1390s (2011–2021), to the point where estimates suggest that by the end of 1403 (March 2025), purchasing a 75-square-meter apartment in Tehran would require several times a middle-class household’s annual income. Even if prices remain stable, this trend will continue to deepen the accessibility crisis.

In the absence of meaningful income growth or effective mortgage programs, a large portion of the population has been excluded from the consumer housing market. Genuine buyers have been replaced by investors and owners of multiple properties. In such a structure, consumer demand is severely suppressed, while investment-driven demand plays the main role in maintaining price levels.

Analysis of Table 2: Over the span of 10 years, the purchasing power of the rial has declined by approximately nine times, and the affordability index has worsened by about 3.5 times. These figures clearly illustrate the growing gap between housing prices and household incomes.

Role of inflation, weakened rial

Another fundamental factor is runaway inflation, which triggered unprecedented shocks in the housing market in the second half of the 1390s. Since 1397 (2018), with the return of sanctions, depreciation of the national currency, and rising inflation expectations, the annual inflation rate has never fallen below 40%. As a result, housing — like other assets — has become a safe haven for capital.

Official PPP data shows that the domestic purchasing power of the rial in 1403 was nearly nine times lower than in 1393 (2014–2015). In other words, if 10,000 rials could buy the equivalent of one dollar in 1393, the same item would cost 90,000 rials in 1403. This clearly reflects the severe devaluation of the rial and the direct pressure on household purchasing power.

Are current prices realistic?

Given the stark gap between prices and incomes, the question arises: are today’s housing prices realistic and sustainable, or are they inflated and speculative? The answer is a mix. On the one hand, rising construction costs (materials, wages, land) nominally justify current prices. On the other hand, the absence of consumer demand and declining transactions indicate this price level is unsustainable in the long term.

In other words, housing in Iran has reached a point where it is too expensive for end-users and illiquid for investors. In this situation, investment returns are unsatisfactory, and hopes of homeownership for the middle class have faded. The market is drifting toward a slow but persistent recession.

Mortgage bonds market: missed opportunity

Mortgage financing instruments, particularly housing bonds (known as “Tessah”), have emerged as a significant phenomenon in the past decade. However, their extreme price volatility has become a barrier for buyers. While these bonds were intended to facilitate loan access, their purchase cost in some cases has exceeded 70 to 80 million tomans just to qualify for a full loan in Tehran.

The experience of recent years — rising to 180,000 tomans per bond in 1400 (2021–2022) and falling to 100,000 tomans in 1402 — demonstrates unstable credit policies and the sensitivity of demand to inflation expectations and purchasing power. Put simply, even when housing loans are available, the upfront cost of purchasing bonds is unaffordable for many.

(The right panel of Figure 1 is not shown here in text format.) The chart and tables collectively underscore a few takeaways: (a) Housing prices remained relatively flat (in real terms) in the early 1390s when inflation was moderate, then exploded in nominal terms once inflation spiked; (b) Cumulative inflation severely eroded the rial’s value, but housing managed not only to keep up but to exceed inflation after 1397, resulting in real price gains for property owners; (c) The volatility in specialized markets like housing bonds (not shown in figure) also correlates with these macro-trends, as explained in the prior section.

Will 1404 bring stability?

The answer depends on macroeconomic and policy factors. In the baseline scenario, inflation is projected to range between 30% and 40% in 1404. Under such conditions, nominal housing price growth is expected to be around 10% to 25%, which lags behind inflation. In other words, real prices (adjusted for inflation) may remain flat or even decline.

Real demand is expected to remain weak, and transaction volumes will likely stay low. Meanwhile, despite initiatives like the National Housing Movement, supply is unlikely to affect the market in the short term. Thus, the market may remain in a state of suspension — neither a booming recovery nor a sharp collapse.

Alternative scenarios: risk, hope

In a pessimistic scenario, if inflation worsens due to factors like subsidy cuts or further rial depreciation, housing prices could surge again — possibly outpacing inflation. Conversely, a credit crunch or banking crisis could also restrain investment demand, pushing the market into a deadlock.

In an optimistic scenario, a reduction in political tensions and improved international relations could strengthen the rial and control inflation. Such changes could reduce real housing prices and improve purchasing power. However, this scenario is unlikely in the short term and requires structural economic reforms.

Unprecedented market compression

At the start of 1404, Iran’s housing market was in a contradictory state. Prices, from the seller’s perspective, continue to rise, yet from the buyer’s point of view, homeownership is virtually impossible. The lack of effective financing tools, weak credit policy, and severe income inequality have all intensified the crisis.

In this context, a sudden price surge is unlikely, but a continued recession — with slight nominal growth and falling purchasing power — is the most probable outcome for 1404. The housing market has reached a point of stagnation that will not be resolved without macroeconomic reform.